Why use an insurance broker?

Why use an insurance broker?

An insurance broker can save you time, money and worry. Just like an accountant or lawyer who provides you with professional advice, based on years of training and experience, a qualified broker can do the same with your insurance.

Insurance can be incredibly complicated to fully understand, and an insurance broker can help you understand the details of a policy and also work out what level of cover you need so that you are properly protected.

Using a broker doesn’t necessarily cost more. Often it costs less because brokers have knowledge of the insurance market and the ability to negotiate competitive premiums on your behalf. In addition, because insurance brokers deal with a range of insurance companies directly, sometimes they can access policies that are not available to most consumers.

If the worst happens and you do have to make a claim, a broker will act on your behalf, liaising with the insurance company to negotiate the best possible outcome for the client. So whether it’s home, car, life or business insurance, brokers are the best, most trusted source of advice available to make sure you are properly protected.

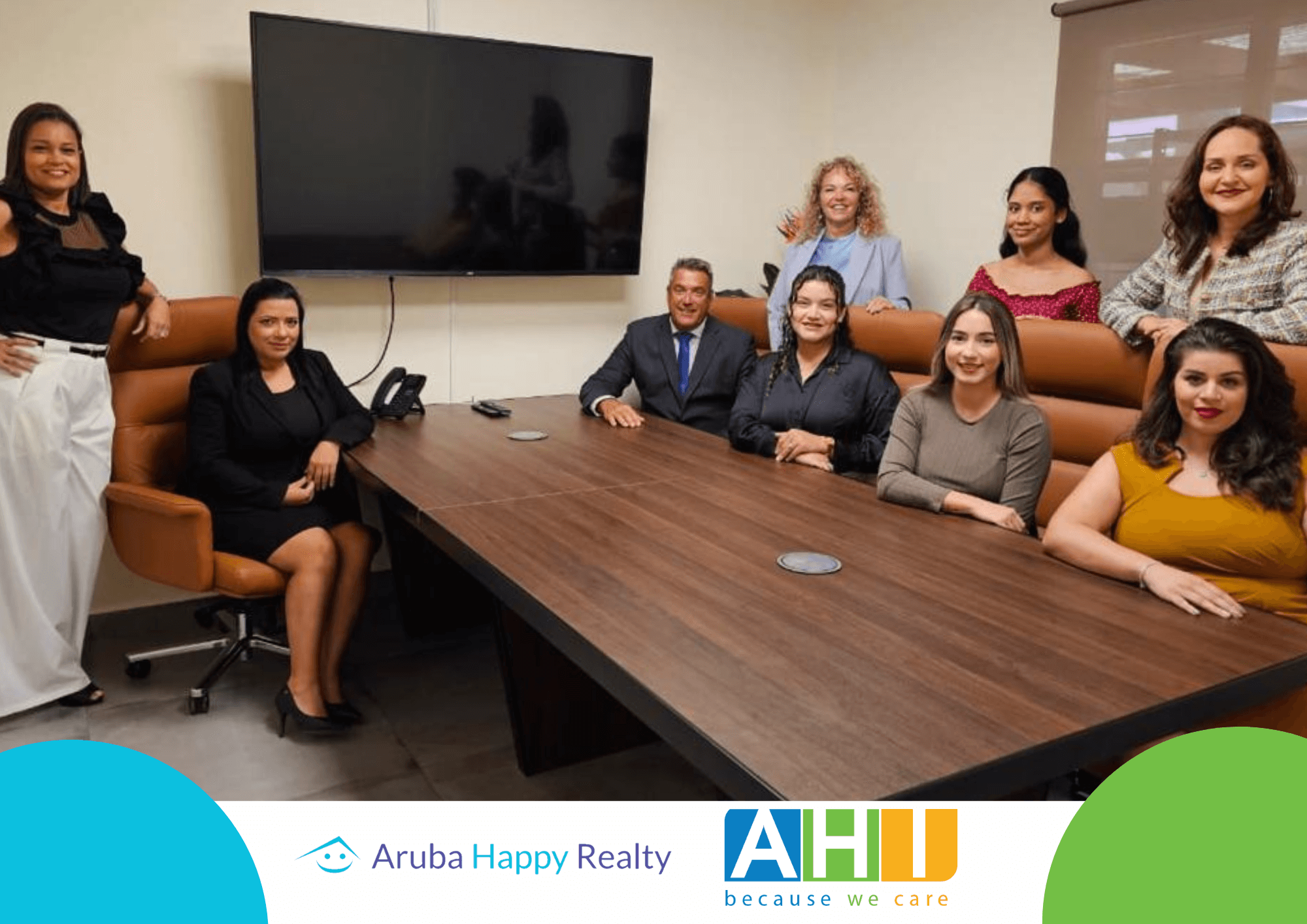

Our Team

Martin Franke

Managing Director

Barbara Franke

Financial Manager

Melissa Piñeros Agudelo

General Manager

Luis Ras

Private and Business Insurance Advisor

Lydienne Rollock

Business, Life and Mortgage Account Manager

Gwendeline Geerman

Administrative Assistant

Kandly Ras

Financial Assistant

Hayley Perez-Cornelio

Collection and Sales Assistant

Eliane Franken

Frontdesk and Administrative Assistant